Are Coaching Buyouts in College Football Too High? A Comparison to the Dot-Com Bubble

Introduction

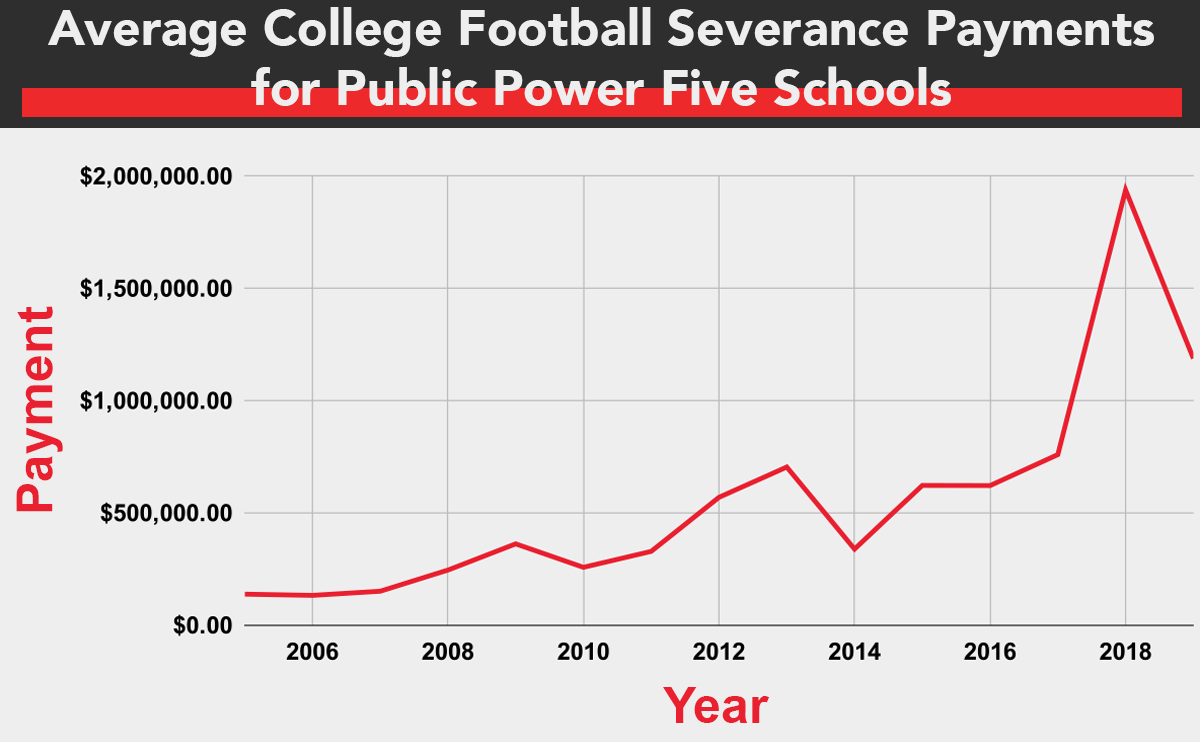

In recent years, we’ve witnessed a dramatic increase in contract buyouts for head coaches in college football. Schools are committing tens of millions of dollars to buy out failed coaching contracts—regardless of the on-field success of the coach. At the same time, in the business world, the late-1990s “Dot‑com bubble” (1995-2002) stands as a classic example of a rapid escalation in valuations and promises, followed by a sharp reckoning.

Is the world of college-football coaching buyouts heading toward a similar boom-and-bust dynamic? In this article, we’ll examine the numbers of buyouts, review the dot-com bubble data, and ask whether the escalating buyout market may be unsustainable.

Section 1: The Rise of Coaching Buyouts

A snapshot of the numbers

-

According to data from USA Today and aggregated by outlets: for the 2023 season, several of the largest buyouts among major FBS schools included:

-

Kirby Smart (Georgia Bulldogs) – ~$92.62 million. (Boardroom)

-

Jimbo Fisher (Texas A&M Aggies) – ~$77.56 million. (Boardroom)

-

Brian Kelly (LSU Tigers) – ~$70.02 million. (Saturday Down South)

-

-

By late 2025, buyouts for head coaches had ballooned further. One data set listed the top buyouts as:

-

On the broader level: The five years ending 2021 showed that from Jan. 1 2010 to Jan. 31 2021, the “Power 5 and Group of 5 programs” owed more than $533 million in “dead money” (buyouts) to coaches and assistants. (ESPN)

-

Moreover: since the beginning of the 2022 season, one report finds ~$146 million in buyouts among Power 5 schools alone. (ESPN)

Why have buyouts escalated?

-

Guaranteed contracts have become more common. As one story puts it: “The first fully guaranteed contract is believed to have been signed in 2007 … Ten years later … a 10-year deal worth $95 million.” (CBS Sports)

-

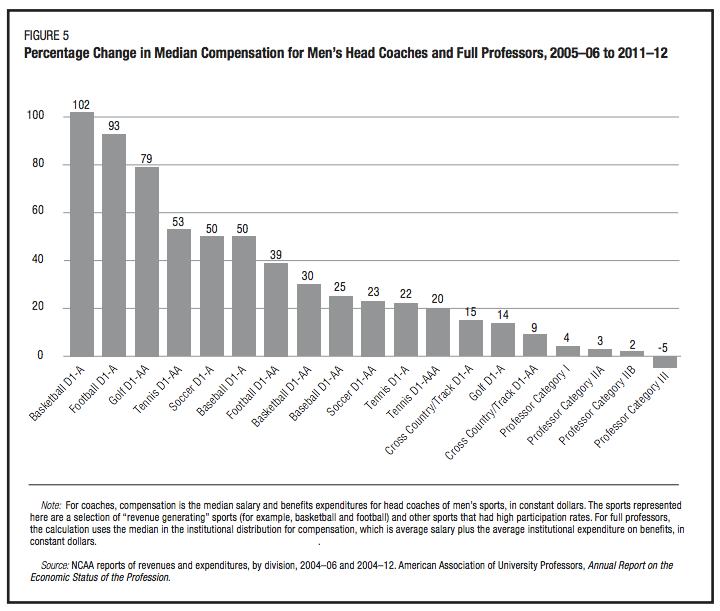

The competition for elite coaches is intensifying. Large revenue potential (TV deals, bowl games, playoff access) mean that schools view hiring the “right coach” as a high-stakes investment.

-

Once contracts are guaranteed, buyouts become de-facto termination-payments; the coach’s salary becomes a sunk cost if things go sideways.

-

The arms-race mentality: when one school offers an enormous contract (and thus buyout), others feel they must respond to keep up.

The concern

Are these buyout figures sustainable? When a school pays $70-100 million to a coach they’re firing (or would fire), that money is diverted from other uses. It raises questions: How does this affect athletic department budgets? What happens if programs underperform repeatedly and schools face financial pressures? Could there be a systemic correction or “bubble” in coach-contract valuations?

Section 2: The Dot-Com Bubble – A Quick Review

What happened

-

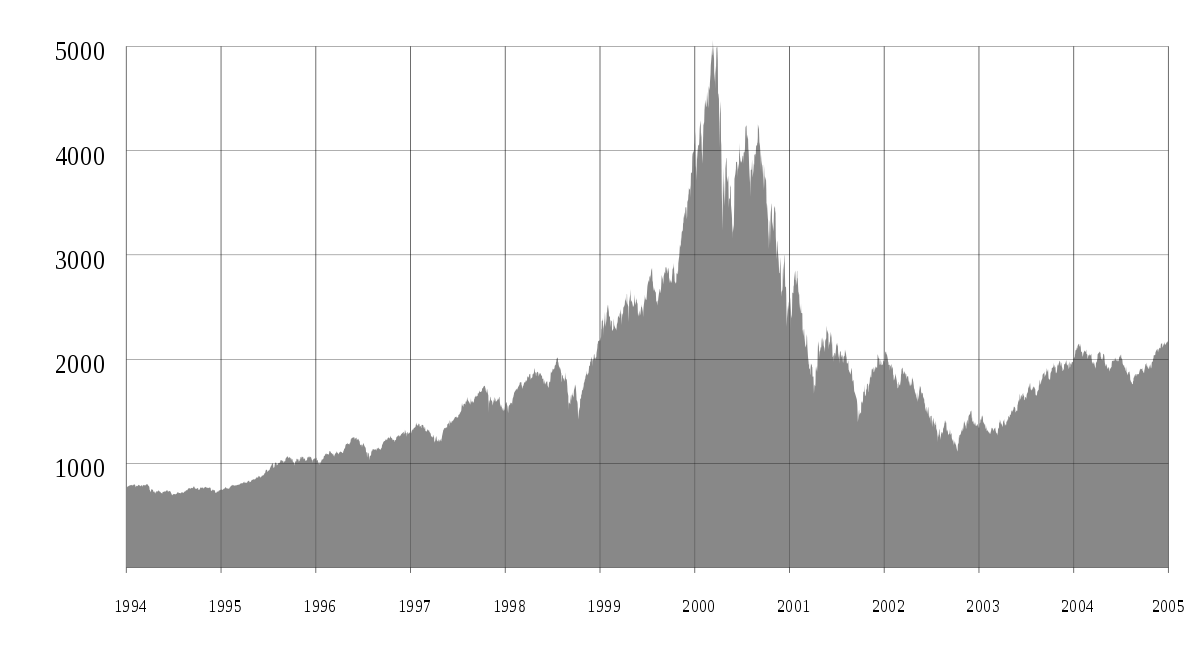

The Nasdaq Composite index rose from ~750 in early 1995 to a peak of 5,048.62 on March 10, 2000. (MoneyWeek)

-

After the peak, the index collapsed to around 1,139.90 by October 4, 2002—a drop of roughly 77%.

-

Estimates suggest more than $5 trillion in market value was erased in the tech sector during that downfall. (Wikipedia)

-

The bubble was characterized by exuberant valuation of companies with little or no earnings, especially internet startups, and massive speculative investment.

Key lessons

-

Rapid escalation in valuations doesn’t guarantee actual performance or sustainability.

-

Once expectations outran fundamentals, the correction was sharp.

-

It took years for full recovery; for example, it took until 2015 for Nasdaq to regain its March 2000 high. (Press Democrat)

-

Many firms that were overhyped failed or shrank dramatically.

Section 3: Drawing the Comparison

Similarities

-

Escalation of commitments: Just as tech companies saw valuations skyrocketing, college programs are increasingly committing to massive guaranteed contracts (and buyouts) for coaches.

-

High-stakes investment: In both cases, the logic is “spend big now to win big later” — whether that’s dominating an industry or dominating college football.

-

Escalating expectations: In college football the expectation of winning quickly (big games, conferences, playoff) drives urgency; in the dot-com era, the expectation was rapid growth of web companies.

-

Potential misalignment of risk: In tech, many companies were valued despite minimal earnings. In college football, schools are making large guarantees with less guarantee of sustained success, and termination means large payout anyway.

Differences

-

Different markets: One is the public equity market of billions of investors; the other is the athletic-department / university financing realm.

-

Revenue sources: Many top college football programs have large revenue streams (TV, bowl games, merchandise, etc.), which arguably justify higher spending. But that may not always shield risk.

-

Contract vs. investment timeline: The dot-com bubble was about future potential; coaching buyouts are about backward-looking guarantees and future termination risk.

-

Survivors vs. fungibility: In tech, many firms failed and dropped out; in college football there are fewer “firms” (programs) and more continuity—but the risk is institutional financial stress.

The key question: Is there a “bubble”?

When we talk about a bubble, we mean inflated commitments relative to underlying value, with the risk of a sharp correction. Are coach buyouts analogous?

One could argue yes:

-

Buyouts exceeding $50-100 million (for a single coach) are extraordinary in any context.

-

The “market” for coaches seems to be escalating rapidly—possibly driven by competition rather than careful calculus.

-

If programs underperform and schools cannot sustain the spending, corrections may occur (e.g., smaller contracts, more offset clauses, less guarantee).

On the other hand, one could argue no:

-

Many elite college football programs generate enormous revenues, perhaps justifying large contracts.

-

Unlike highly speculative tech firms, the business model (sell tickets, TV rights, donations, NIL deals) is more established.

-

Schools still have incentives to win and to invest in successful coaches; so it may not be purely speculative.

Section 4: The Warning Signs

-

The steepest buyouts (e.g., $100 million for Kirby Smart) may act as a “sunk cost” risk: If things go wrong, the cost of termination is enormous.

-

Smaller or less-funded programs may face financial strain if they try to emulate elite programs.

-

If many schools begin locking up coaches with massive guarantees and corresponding buyouts, the cost of failure may climb system-wide.

-

As with the dot-com bubble, the driver of escalation (competition, hype) may outpace fundamentals (sustained wins, program stability, return on investment).

-

Contracts may shift to include stricter offset clauses or performance triggers; if so, that may be evidence of a correction beginning.

Conclusion

The rapid rise of head-coach buyouts in college football asks a serious question: Are we in an unsustainable escalation of commitments? The dot-com bubble of the late 1990s provides a cautionary tale: dramatic promises, escalating valuations, and then a sharp downturn.

While the analogy is not perfect, the key takeaway is that institutions (whether schools or investors) should remain mindful of risk-vs-reward, sustainability, and what happens if expectations are not met.

In college football: when a school writes a $100 million guaranteed contract with a $100 million buyout, it must ask: if the coach fails to deliver, how will that payout impact the program, the budget, the students, the university? Just because the money is there today doesn’t mean the risk is gone.

Call to Action

School administrators, athletic-directors, donors, and fans alike should ask:

-

What realistic return do we expect on a multi-million-dollar guaranteed coach contract?

-

Do we have contingencies for underperformance?

-

Are we maintaining fiscal discipline even as competitive pressures rise?

The big question remains: if coaching buyouts continue to grow unbounded, will we eventually see a systemic “correction” — and will schools be prepared? The dot-com episode reminds us that when escalation gets detached from fundamentals, the reckoning may be painful and protracted.

No comments:

Post a Comment