Brian Kelly’s Tenure at LSU: Promise, Performance, and Fall

When Brian Kelly arrived in Baton Rouge in December 2021, the expectations were high. He was hired away from University of Notre Dame after a solid tenure there and was given a long‐term contract by LSU. (ABC News)

Key Facts & Figures

-

Contract: A 10-year deal worth about $95-100 million. (On3)

-

Buy-out: Around $52-54 million (based on estimates) if fired early. (CBS Sports)

-

Record at LSU: 34-14 overall across roughly four seasons. (The Washington Post)

-

SEC record under Kelly: 19-10. (https://www.wcax.com)

-

2025 season record at time of firing: 5-3 overall, 2-3 in SEC play. (The Washington Post)

-

The ending trigger: A 49-25 home loss to No. 3 Texas A&M Aggies (Texas A&M) on Oct 25 2025. (ABC News)

Why Did it End?

Despite the solid overall win-loss record, LSU’s leadership concluded that Kelly’s tenure had not reached the level the program demands. Some of the specific concerns:

-

No appearance in the College Football Playoff during his time at LSU — a key benchmark for a program of LSU’s stature. (The Washington Post)

-

The program started the 2025 season 4-0, but faltered and lost three of its last four games leading up to the Texas A&M blow-out. (CBS Sports)

-

The blow-out loss at home raised questions about competitiveness in high-stakes games: “When Coach Kelly arrived … we had high hopes… Ultimately, the success at the level that LSU demands simply did not materialize.” — Woodward. (foxsports.com)

Immediate Aftermath

-

Kelly was relieved of his duties on Sunday night, Oct 26, 2025, effective immediately. (LSU)

-

Associate head coach & running backs coach Frank Wilson was named interim head coach. (ABC News)

-

LSU immediately launched a national search for a new head coach. (https://www.waff.com)

Scott Woodward’s Role and Departure

Scott Woodward, the athletic director at LSU since 2019, was the person who hired Kelly and was central to the department’s strategic direction. His departure became the next major development.

Context and Criticism

-

Governor Jeff Landry publicly criticized Woodward’s role in the Kelly hire (and earlier coaching contracts) and declared that Woodward would not pick LSU’s next football coach. (The Guardian)

-

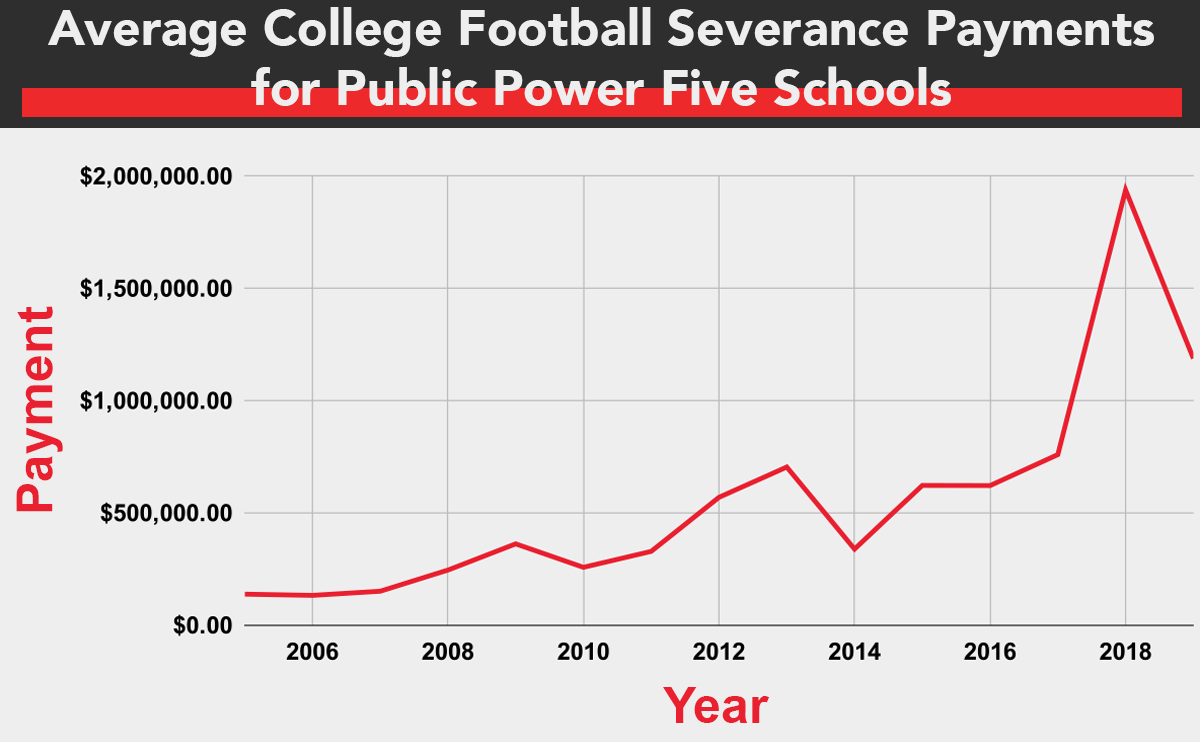

Landry pointed to a “pattern” of expensive buyouts: he referenced Kelly’s ~$54 million and a prior deal at Texas A&M that resulted in a ~$77 million buyout under Woodward’s previous employ. (Louisiana Sports)

Departure

-

LSU and Woodward parted ways effective late October 2025. (nypost.com)

-

Verge Ausberry, executive deputy athletics director, was named interim AD. (nypost.com)

What It Means

Woodward’s departure signals a broader reset: the institution is not only changing its head coach but reworking leadership of the athletics department — presumably to manage risk, accountability, and cost-control of high‐stakes coaching hires.

Bigger Picture & Implications

Financial Stakes

-

The buyout for Kelly is one of the largest in college football history. (CBS Sports)

-

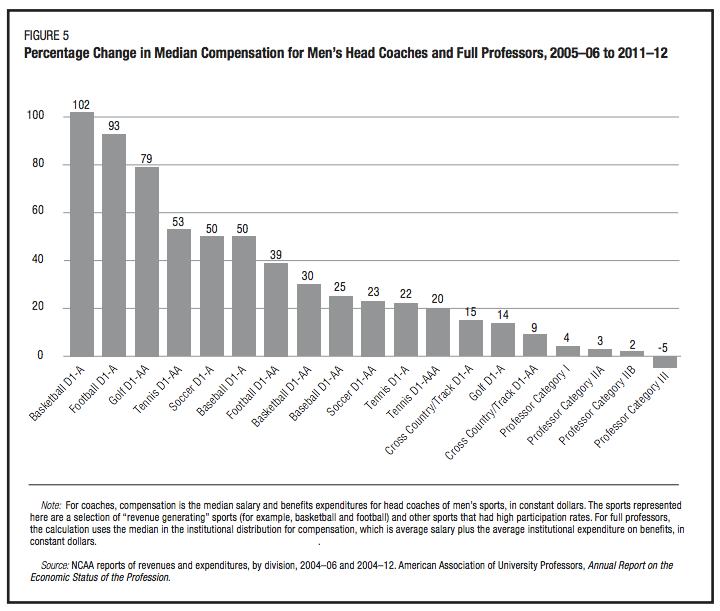

Signing multi‐year, high guarantee contracts for coaches carries major institutional risk (especially if results don’t follow).

-

With the AD’s departure and the governor’s involvement, there’s increased scrutiny over how financial decisions are made in college sports at public universities.

Expectations vs. Reality

-

LSU has a rich history with national championships (for example under Ed Orgeron in 2019). Kelly’s tenure was solid but not elite.

-

For a “blue-blood” program in the SEC, success often means competition for national championships — anything short is seen as underperforming.

-

The mid-season firing (rather than waiting till after the year) suggests urgency and a determination to change course immediately.

Organisational Change

-

The simultaneous (or near-simultaneous) firing of both the head coach and the athletic director is unusual and signals institutional upheaval.

-

The governor’s move to preclude Woodward from hiring the next coach shows involvement of state government in public-university athletics governance — noteworthy for governance watchers.

Looking Ahead

-

LSU now must find a new head coach and new AD leadership, while stabilizing the football program amid high expectations and high stakes.

-

The incoming coach will face immense pressure: succeed quickly or risk becoming the next casualty in this cycle.

-

Financial prudence, structural safeguards (buyout terms, performance metrics) and alignment between coach, athletics department and university will likely receive more attention.

-

For fans, boosters and broader stakeholders: this moment represents a crossroads — either LSU resets and re-builds upward, or the program risks sliding.

Conclusion

The departures of Brian Kelly and Scott Woodward at LSU mark a dramatic inflection point for the university’s athletics program. Despite a respectable record (34-14) under Kelly, the failure to reach major milestones (Playoff, national championship) combined with high financial cost for early termination triggered the change. Woodward’s exit underscores the extent to which leadership, contracts and strategic decisions are being recalibrated in the face of mounting pressure for elite results and fiscal accountability.

- nypost.com

- And The Valley Shook

- reuters.com

- The GuardianHere’s a detailed account of the shake-up at Louisiana State University (LSU) athletics — the firing of head football coach Brian Kelly and the subsequent exit of athletic director Scott Woodward — with actual data and context.

Brian Kelly’s Tenure at LSU: Promise, Performance, and Fall

When Brian Kelly arrived in Baton Rouge in December 2021, the expectations were high. He was hired away from University of Notre Dame after a solid tenure there and was given a long‐term contract by LSU. (ABC News)

Key Facts & Figures

-

Contract: A 10-year deal worth about $95-100 million. (On3)

-

Buy-out: Around $52-54 million (based on estimates) if fired early. (CBS Sports)

-

Record at LSU: 34-14 overall across roughly four seasons. (The Washington Post)

-

SEC record under Kelly: 19-10. (https://www.wcax.com)

-

2025 season record at time of firing: 5-3 overall, 2-3 in SEC play. (The Washington Post)

-

The ending trigger: A 49-25 home loss to No. 3 Texas A&M Aggies (Texas A&M) on Oct 25 2025. (ABC News)

Why Did it End?

Despite the solid overall win-loss record, LSU’s leadership concluded that Kelly’s tenure had not reached the level the program demands. Some of the specific concerns:

-

No appearance in the College Football Playoff during his time at LSU — a key benchmark for a program of LSU’s stature. (The Washington Post)

-

The program started the 2025 season 4-0, but faltered and lost three of its last four games leading up to the Texas A&M blow-out. (CBS Sports)

-

The blow-out loss at home raised questions about competitiveness in high-stakes games: “When Coach Kelly arrived … we had high hopes… Ultimately, the success at the level that LSU demands simply did not materialize.” — Woodward. (foxsports.com)

Immediate Aftermath

-

Kelly was relieved of his duties on Sunday night, Oct 26, 2025, effective immediately. (LSU)

-

Associate head coach & running backs coach Frank Wilson was named interim head coach. (ABC News)

-

LSU immediately launched a national search for a new head coach. (https://www.waff.com)

Scott Woodward’s Role and Departure

Scott Woodward, the athletic director at LSU since 2019, was the person who hired Kelly and was central to the department’s strategic direction. His departure became the next major development.

Context and Criticism

-

Governor Jeff Landry publicly criticized Woodward’s role in the Kelly hire (and earlier coaching contracts) and declared that Woodward would not pick LSU’s next football coach. (The Guardian)

-

Landry pointed to a “pattern” of expensive buyouts: he referenced Kelly’s ~$54 million and a prior deal at Texas A&M that resulted in a ~$77 million buyout under Woodward’s previous employ. (Louisiana Sports)

Departure

-

LSU and Woodward parted ways effective late October 2025. (nypost.com)

-

Verge Ausberry, executive deputy athletics director, was named interim AD. (nypost.com)

What It Means

Woodward’s departure signals a broader reset: the institution is not only changing its head coach but reworking leadership of the athletics department — presumably to manage risk, accountability, and cost-control of high‐stakes coaching hires.

Bigger Picture & Implications

Financial Stakes

-

The buyout for Kelly is one of the largest in college football history. (CBS Sports)

-

Signing multi‐year, high guarantee contracts for coaches carries major institutional risk (especially if results don’t follow).

-

With the AD’s departure and the governor’s involvement, there’s increased scrutiny over how financial decisions are made in college sports at public universities.

Expectations vs. Reality

-

LSU has a rich history with national championships (for example under Ed Orgeron in 2019). Kelly’s tenure was solid but not elite.

-

For a “blue-blood” program in the SEC, success often means competition for national championships — anything short is seen as underperforming.

-

The mid-season firing (rather than waiting till after the year) suggests urgency and a determination to change course immediately.

Organisational Change

-

The simultaneous (or near-simultaneous) firing of both the head coach and the athletic director is unusual and signals institutional upheaval.

-

The governor’s move to preclude Woodward from hiring the next coach shows involvement of state government in public-university athletics governance — noteworthy for governance watchers.

Looking Ahead

-

LSU now must find a new head coach and new AD leadership, while stabilizing the football program amid high expectations and high stakes.

-

The incoming coach will face immense pressure: succeed quickly or risk becoming the next casualty in this cycle.

-

Financial prudence, structural safeguards (buyout terms, performance metrics) and alignment between coach, athletics department and university will likely receive more attention.

-

For fans, boosters and broader stakeholders: this moment represents a crossroads — either LSU resets and re-builds upward, or the program risks sliding.

Conclusion

The departures of Brian Kelly and Scott Woodward at LSU mark a dramatic inflection point for the university’s athletics program. Despite a respectable record (34-14) under Kelly, the failure to reach major milestones (Playoff, national championship) combined with high financial cost for early termination triggered the change. Woodward’s exit underscores the extent to which leadership, contracts and strategic decisions are being recalibrated in the face of mounting pressure for elite results and fiscal accountability.

- nypost.com

- And The Valley Shook

- reuters.com

- The Guardian (other reading)

-